By Jennifer Heebner, Editor in Chief

Jewelry sales in 2024 have not been great, but many are hoping that after next week’s U.S. presidential election—no matter who wins—consumers will start buying again.

Things can only go up from here, right? Richemont reported a flat first quarter, sales at indie jewelry stores haven’t been much better, and consumers have been hesitant to spend because of two wars and a highly contested presidential election, making the existing climate a total bummer to shop in.

“Shopping is a feel-good experience—that’s why people spend money on vacation,” says Hayley Henning of Hayley Loves Color, Inc., a marketing and branding specialist in colored gemstones who is based in Miami. “But in difficult times, they hold back. There’s a lot of apprehension in the market today and not just in the U.S.”

Sales to Date

Dealers confirm that 2024 sales have been quiet. Rio Diamond Corp., which sells colored Diamonds and some Big Three gemstones, says that sales since the summer have been slower, with store owners reporting lower tickets than in years past.

“Retailers who have been busy say the value of their sales has diminished,” says Jose Batista of the New York City–based firm. “A lot of people are waiting until after the election to spend.”

Some high-end designers also say that sales are on hold until the election is over, and others suspect that wallets will open more quickly if one candidate in particular wins, but nobody wants to say the latter out loud.

Regardless, Laurie Watt of Maysville, Ky.–based Mayer & Watt is praying for change to happen soon. Her office phone hasn’t been ringing as much as she’d like, but she’s had a few good sales recently. In the past two weeks, she’s had an order for an 8.0–12.0 ct. fine Tanzanite and a $10,000 fine green Tourmaline. There have also been memo requests that turned into purchases.

“I have a feeling that sales will continue to get better,” says Watt.

At Barker & Company in Scottsdale, Ariz., there have been fewer small sales but some nice bigger ones, like the 11.0 ct. heated pink Sapphire that company principal Ann Barker recently shipped out to a store for a trunk show. It sold. For the most part, her West Coast clients are doing well while the East Coast folks seem less busy. Same for some of her designer clients. “Some are saying it’s a bit slow,” she says.

Hope for Better Days

Jaimeen Shah of Prima Gems USA, LLC in New York City anticipates better sales ahead but is not expecting a boom in 2025.

“My best show in 2024 was the AGTA GemFair Tucson back in February, and I already expect the 2025 GemFair Tucson to be my best show again,” he says. “The top 5% will continue to buy, but shoppers for goods that are one step down to commercial quality? We need to see a further price correction to make it exciting for people to purchase again.”

In Houston last weekend (Oct. 26–27), guests who attended the annual Texas Jewelers Association convention got a master class in jewelry data if they sat in on the presentation from Stuller’s Harold Dupuy. He is Vice President of strategic analysis for the Lafayette, La.–based manufacturer and supplier and had 110 slides of numbers to share.

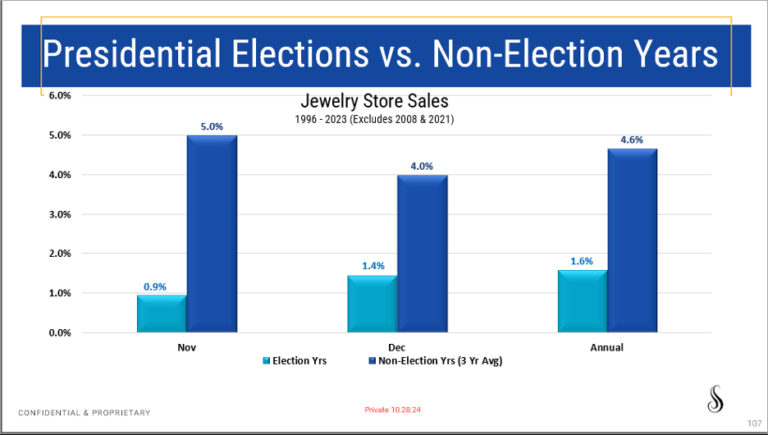

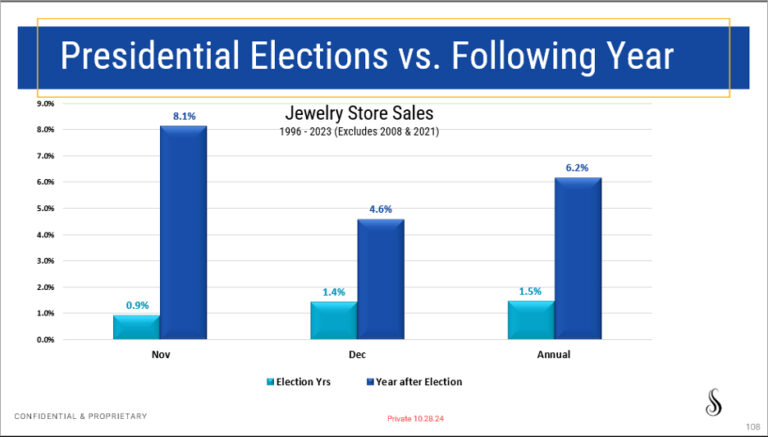

One slide in particular reinforced anecdotal sales reports from this year. Dupuy looked at U.S. government-issued jewelry sales statistics during presidential election years and nonpresidential election years from 1996 to 2023, excluding 2008 and 2021. His analysis reveals that average annual jewelry sales are stronger in the three years after a presidential election than during the election year itself.

“It’s fair to say that people are cautious spenders during presidential election years,” he says. “So, yes, I do think that things will improve.”

This is proprietary content for AGTA and may not be reproduced.